A record RM13b tourism revenue despite sluggish growth last year

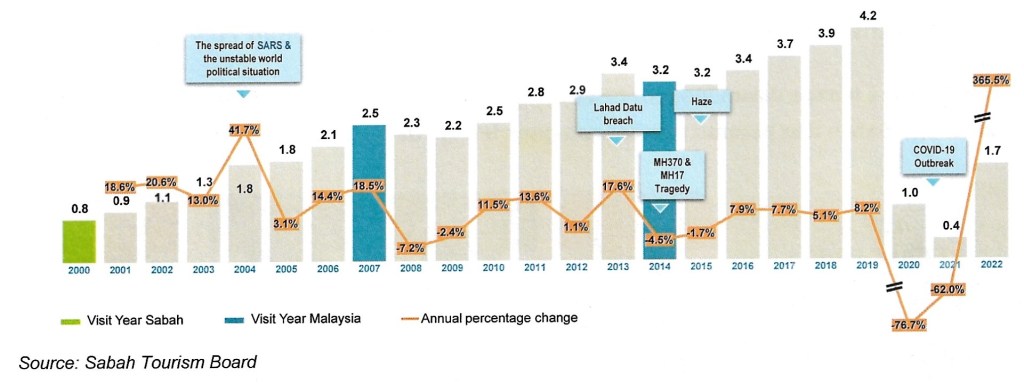

A new method of accounting for tourism has yielded a set of surprising figures. The inaugural Sabah tourism satellite account (TSA) released last week by the Sabah tourism ministry in Kota Kinabalu shows that tourism earned the state an all-time high of RM13b. This is despite a relatively sluggish recovery last year after two years of travel ban because of the Covid-19 pandemic. And it contrasts sharply with the RM9b earned in 2019 when the number of visitors to the state was the highest at 4.2m against a low 1.7m last year. The reason for this “discrepancy” is in the way tourism is defined and measured in the TSA prepared by the Sabah Tourism Board and Malaysia’s Department of Statistics.

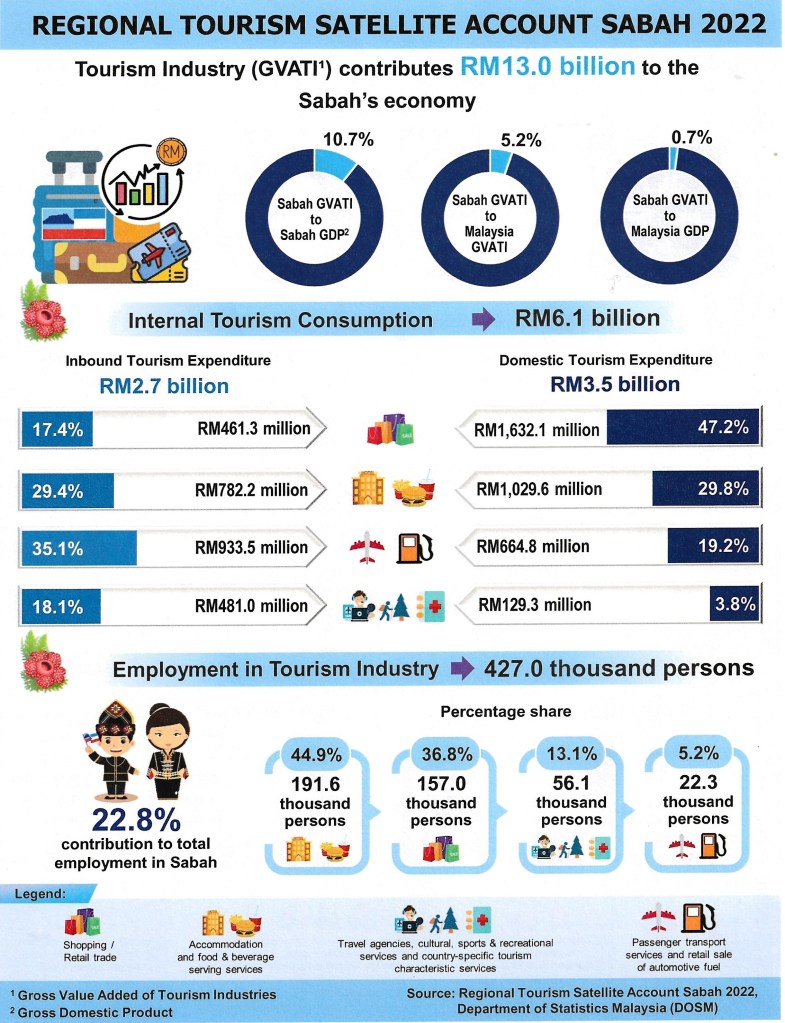

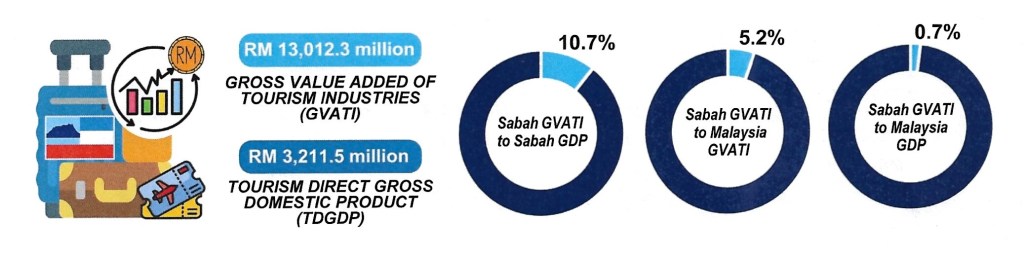

The RM13b is derived from computing the gross value added for tourism industries (GVATI) to measure their performance in four sectors: 1) shopping or retail trade, 2) accommodation, and food and beverage services, 3) travel agencies; cultural, sports and recreational services, and country-specific tourism characteristic services, and 4) passenger transport and retail sale of petrol. Although they are defined as tourism industries, they do not necessarily serve only tourists. For example, not all who dine in a restaurant are tourists. But GVATI does not exclude non-tourism expenditure.

The tourist direct gross domestic product (TDGDP) however would seem to be a more realistic approach as it is tourism specific. To compute it, a distinction has to be made between tourism and non-tourism spending. Not all that the tourist spends is tourism expenditure. For example, part of the price he pays for his dinner at a restaurant is used to buy detergents, electricity and other products used to produce his meal. Such intermediate consumption is not tourism expenditure and thus, along with imports and subsidies, must be subtracted from it. (Net taxes are added to tourism spending.) So it is no wonder that the TDGDP contributed only RM3.2b to the Sabah GDP of RM122b, a far cry from the whopping GVATI of RM13b. Percentage-wise TDGDP’s 2.6 per cent contribution to the state GDP renders it rather insignificant to the Sabah economy. Conversely, the RM13b from GVATI makes up 10.7 per cent of the state GDP placing it behind agriculture, mining and quarrying, and services. Thus despite the 45 per cent spike in revenue, its contribution to the state GDP has remained unchanged. Sabah’s tourism contribution to the state GDP has been hovering around 10 per cent.

Foreign visitors have been trickling in since Sabah reopened its doors to them in April last year. But their number was a low 300,000 last year. They spent about RM612m, making up slightly less than a quarter of total internal tourism spending of RM6.1b. Missing were visitors from China who numbered about 600,000 in 2019 because China closed its borders in an attempt to wipe out the Covid-19 disease. They were the top foreign visitors before the Covid-19 pandemic. Last year, visitors from neighbouring Brunei topped the foreign arrivals at 77,000. South Koreans came in a close second at 55,000.

A boom in domestic tourism which chalked up RM3.5b in expenditure however made up for the shortfall of foreign visitors. This may be attributed to defining the culture of “balik kampung” (back to the village) as tourism. It is when masses of people go back to their villages or hometowns for family reunion during festive occasions such as Hari Raya Puasa, Chinese New Year, Deepavali and Christmas. Also the rather broad definition of a tourist as someone who makes an overnight trip may have inflated the number. A day-tripper or “excursionist” in the satellite account is one who stays less than 24 hours in a place he visits. It is doubtful if he contributes to tourism spending as defining a visitor becomes strange and confusing. According to the technical notes of the Sabah TSA, anyone who makes a trip of at least 50km to and fro between his residence and a place outside his usual environment, spending at least four hours there for tourism purposes, is a visitor. Similarly, he is a visitor even if he travels less than 50km to and fro between his house and that place as long as he spends at least four hours there and uses some tourist facilities such as a restaurant. Yet he is just an excursionist and not a tourist even though his trip is for tourism.

In any case, domestic tourism has always dominated the industry even at the best of times where there were hordes of foreign tourists. And last year’s numbers were nothing to shout about when compared with 2019 performance: a record 22m domestic visitors spent RM8b. Yet the Sabah TSA is an eye-opener. The hue and cry over hikes in air fares did not stop about 1.4m people from peninsular Malaysia and Sarawak from travelling to Sabah last year. Peninsular and Sarawak travellers spent about RM1.7b and RM350m respectively.

Based on GVATI, shopping or retail trade was the biggest contributor to Sabah’s economy last year at RM5.6b or 43.3 per cent while accommodation and food and beverage accounted for 29.4 per cent at RM3.8b.

One worrying aspect of the industry was the over-supply of tourism goods and services by some RM12b. Tourism authorities would have to look deeper and ensure this would not occur in future. Too many competing businesses may lead to cut-throat competition and deterioration of the quality of goods and services. Understandably some hotels may still be struggling to fill their rooms. Last year hotel occupancy was reported to be about 40 per cent. It has improved this year but hovering at about 50 per cent.

On the brighter side, the tourism industry is an important employer. Last year, it employed about 430,000 people, constituting slightly more than a fifth of Sabah’s labour force of 1.9m. The accommodation and food and beverage sector accounted for almost half of all employment offering 192,000 jobs while retail trade employed 157,000 people, making it tourism’s second biggest employment sector.